We’ve talked a lot about valuation metrics that determine the value of your FBA business when the time comes to sell it. But looking at metrics like Inventory to SDE ratio or whether Advertising as a % of sales is trending up and down, is quite dull and boring.

Instead, let’s talk about things that matter to buyers. Ultimately, the marketplace is the one determining the value of your business, and businesses that the average buyer “likes better” end up selling for higher prices. It really is as simple as that.

And the metrics? They’re just an abstraction layer.

When valuing a business, we might say that a low Inventory to SDE ratio is great, but what we really mean is that it’s great if the owner of the business doesn’t have to commit a large amount of money into inventory. The difference is subtle, but it’s there.

So diving into it, what are the 17 most important things that buyers look for and appreciate when seeking an Amazon business to acquire.

#1 – Growth

There’s a good reason why growth is the first item on this list.

If we leave the total earnings aside, the growth trend of a business is often the biggest value-affecting factor by far.

Whether your business is growing or declining is going to make a difference beyond what most people could imagine.

To illustrate, let’s look at two hypothetical businesses that both generated $100,000 in Seller’s Discretionary Income in 2019.

As the valuation multiple is usually applied to trailing 12 months’ earnings, one would expect the businesses to score similarly.

But looking at growth trends, we’ll see that Business A got to the $100k from making $50k the year before, while Business B made $200k the year before.

As a result, Business A is a growing business that is likely to end up with a valuation in the 3x range (or $300k), while Business B is very likely a distressed and might see a multiple as low as 1.5x (or $150k).

That’s a two-fold difference in the market value, dictated purely by growth trends.

It’s not just the bottom-line earnings that are important, though. While valuation multiples are applied to earnings, when looking at growth trends, your revenue is, arguably, even more critical.

If your sales are steadily going down, then it’s likely that any increase in profit is short-lived.

But as with everything, nothing can be viewed in isolation. Ultimately, it’s the story behind the numbers that matters more than the numbers themselves.

Action Item #1: Make sure your business is growing across all key metrics – from total sales all the way down to your net profit.

#2 – Healthy Profit Margin

Buyers dislike risk more than anything, and a thin profit margin is a surefire indicator of heightened risk.

While there’s no easy answer to what’s a healthy profit margin to aim for, an unhealthy one is easy to notice and can destroy your valuation.

The reasons behind it are simple – think of your profit margin as a safety net of sorts. The lower your profit margin, the less armor you have when getting into a fight. And fight you will.

You’ll fight with your competition, who’s continually looking for ways to beat you down, either with prices or with product quality. A small margin means you might not have the money to fight out price wars or improve your products.

…with the market, that is always on the lookout for cheaper and better products, while being completely unpredictable. Sure, people might be buying your luxury soap for $65 a bar today, but what’s going to happen if a recession hits tomorrow?

…with Amazon itself, who hikes up the prices of their on-platform advertising whenever it can. Don’t have enough of a margin to increase your ad budget? Well, you’re out of luck, sir.

That’s a lot of battles to be prepared for at all times, so you’ll need all of the armor you can get.

Unfortunately, while one of the biggest value-influencers, the profit margin is also an incredibly difficult thing to change once your business is already going. It’s something you’ll have to be mindful of from Day #1 when coming up with the products that you’re about to sell.

Action Item #2: Aim for a Gross Margin of at least 20-30% to be able to fight out the battles that your business is drawn into.

#3 – Branding

It’s easy to disregard the importance of branding when building an Amazon business. After all, who cares, right? As long as the product ranks for the keywords it needs to and has good reviews, it’s going to sell.

Yes and no.

While your unbranded “Stainless Steel Baking Pan, Great for Pancakes and French Toast” that arrives in a generic cardboard box may sell, it’s unlikely that you’ll have a lot of people talking about it.

Or if they are, then your product gets referred to as “something I found on Amazon.” Jeff loves that, but you shouldn’t. And neither do buyers.

Instead, try coming up with a catchy brand name, spend a little bit of money on designing a logo and coming up with packaging, and you’ll be in a much better place.

Why? Three main reasons.

Firstly, branding allows word-of-mouth to work. In the above example, you can’t possibly expect anyone to recommend your product to friends: “Hey, it’s a great pan you’ve got! Where can I find one?” – “Oh, just go to Amazon, search for a stainless steel pan, and it’ll be somewhere or page 1. Or maybe 1, I can’t remember“.

But with proper branding, the second part of the conversation would instantly change to: “Just look for [Your Brand] on Amazon.” Huge difference.

Secondly, branding makes your business look more established. Perception matters. A lot. Beautiful branding makes the business look like more than a fly-by-night Amazon account with a couple of unrelated, opportunistic, products in it.

Not only will this help you sell more of your product by seeming a more trustworthy business to buy from, but business acquirers like it too.

Thirdly, branding helps protect you against copycats. Having a brand and an associated trademark will help you protect your business against other sellers who can otherwise easily come and steal your sales. Listing hijacking is a serious concern with Amazon products, and, as a result, few buyers are even willing to look at Amazon businesses that are not trademarked and enrolled in Brand Registry.

Action Item #3: Come up with a brand name for your Amazon business. Then get it trademarked and use it on your packaging.

#4 – Good & Consistent Review Score

Everybody who’s dealt with Amazon even a bit is likely to agree that there are few things more important than a good review score.

Reviews are the lifeblood of an Amazon listing and can easily make or break a product.

So it shouldn’t come as a surprise that buyers also put a lot of focus on the review profiles of the businesses they’re considering buying.

Good reviews are essential. Your main product having a review score of, say, 3.5 stars, is a tell-tale sign that there’s something wrong with the product.

Sure, the product might still sell. But that’s only part of the story. A low review score is an open invitation to your competition to come and offer a better product. Once that happens, is yours still going to sell? Buyers are going to bet that it’s not.

But as important as it is to make sure your review score is good, you’ll also have to make sure it’s consistent.

Let’s assume an average review score of 4.0. It’s a high score. Some buyers might be picky and only look at products with exclusively 5-star reviews, but most are okay with a 4.

So, we’re fine. Right?

Not necessarily.

Looking further into the historical data, we might see that while the product’s average review score is 4.0 today, it was 4.8 a year ago and has been going down since.

Similarly to revenue and profit, trends matter with reviews too.

The moment a downward trend can be observed, the prospective buyer of your business will stop focusing on the fact that the review score is decent today, and start focusing on whether it’s going to keep declining.

Action Item #4: Keep an eye on your reviews all the time. The moment you notice a downward trend, make it your priority to fix it.

#5 – Healthy Product Distribution

Product distribution is one of the interesting metrics that varies anywhere from “incredibly important” to “not even worth a discussion.” The difference? The size of the business, first and foremost.

But let’s take a step back and look at what we’re talking about in the first place.

In short, your product or SKU distribution is the percentage that each one of your products contributes to your business’s overall sales.

Nearly every business has its winners and losers, and rightly so. If yours doesn’t, then you’re probably leaving opportunities on the table. But there’s a big difference between the best product contributing 80% of your overall revenue VS 25%.

Needless to say, that percentage represents a risk, in its purest form. It doesn’t take a genius to realize that if the health of the entire business depends on a single product, then something happening to that one product would jeopardize the whole business. And buyers know this, which is why single-product stores are often valued at much lower multiples than those with a nice and healthy SKU distribution.

Size Matters, though…

As I briefly mentioned above, the importance of diversification varies and depends on the size of the business.

That’s because different acquisition sizes attract different types of buyers. And who the buyer is matters a lot, as while diversification is critical to someone who’d only run the one business, it’s less important to someone who already has an existing portfolio of hundreds of products, across tens of businesses.

While there are no set “tiers,” as a general rule of thumb, you can assume that in the sub-$1 Million range, you’d be dealing mostly with buyers for whom product diversification is incredibly important. Above the million-dollar mark, there will be plenty of buyers who won’t care as much.

In summary, if you’re expecting to sell your business before it hits the $1M mark, you should pay serious attention to increasing product diversity. Above that mark, it’s still important, but you may be able to get away with it more easily and take less of a valuation hit.

Keep in mind, though, that all of this takes time. Often, a lot of time. While you might be able to launch a couple of new products reasonably quickly, the product will also need to be selling for at least 6-12 months before they can be considered a stable part of the business.

Action Item #5: Make sure a single product doesn’t represent more than a third of your gross revenue. If it does, consider introducing new products.

#6 – Sufficient History

In short, the more history business has, the more certain can one be in its future. Some may argue with this statement, but this doesn’t change the fact that most buyers consider it valid and value businesses accordingly.

Having enough history is essential for many reasons. The most important ones are:

- Trends. We’ve already discussed how important growth is. But to be able to tell that a business is indeed growing, and not just experiencing seasonality, we’ll need sufficient data.

- Test of Time. Your 6-month business might be striving only because your competition hasn’t yet noticed you, or had enough time to react. But for a company that’s running for 2-3 years, that’s less likely.

- Reviews. On Amazon, reviews are everything. And the more time passes, the more reviews your main products will have, making the products more defensible and the business more valuable.

So we’ve established that history is essential. Here’s the million-dollar question, though: How much history is enough?

While there’s no direct answer, I’d like to offer you an indicative range:

Less than 1 Year: Your business cannot be sold. (not for anything reasonable, at least).

1-2 Years: Sell if you absolutely must, but you’d be doing yourself and your wallet a favor by holding on past the 2-year mark

2-5 Years: A lot of FBA businesses on the market are in this range. You’ll be right in the middle.

5+ Years: The store will be considered truly established. Over 5 years of solid history means a lot, and you can expect the valuation to reflect that.

Action Item #6: If your business is less than 2 years old, consider NOT selling it and instead, focus on growth. You’ll likely thank yourself later.

#7 – Product Longevity

This one is very straightforward: Buyers like products that remain relevant for years to come.

Think about it. Even if you’re showing profit year over year, if the life-span of your products is only about a year, it essentially means that each year, you’re building a new business.

An approach like this can work wonders for someone who has the will to keep releasing new SKUs, but most buyers look for an existing product portfolio that will remain profitable, regardless of whether they release new SKUs or not.

With online businesses, or “airballs,” like many traditional investors calls them, “What is it that I’m buying?” is an ever-important question. In most cases, one of the main assets that the buyer is buying is the history of your existing products, and thereby an increased barrier to entry. With products that have a short life-span, that part doesn’t exist, and you’re left with just selling your processes and knowledge on regular product launches — something that most buyers don’t consider very valuable.

If I were to summarize all of the above in just one sentence, it would be: “Don’t sell electronics” 🙂

There are other categories where short life-span of products is a common issue, but none are as prominent as electronics and related accessories.

I’m talking virtually anything from actual devices like dashcams or spotlights to cables of any kind, and even accessories like phone cases or ceiling mounts for TVs.

Electronics is such a fast-evolving category that it’s virtually impossible to find a product with a life-span of more than a few years.

There are exceptions, of course. Similarly to how you can release a terrible product in an otherwise “good” category like dietary supplements or kitchenware, it’s possible to find the one electronics product that remains relevant for a decade. But beware – some buyers flat-out ignore the category altogether and won’t even give you the chance to make your point.

Action Item #7: When launching a product, consider how long it will remain relevant. If the answer is less than 5 years, move on and pick a new product.

#8 – Consistent Product Catalogue

Let’s start with an example here and say you’re looking to buy a nice leather bag.

Would you feel more comfortable buying it from a supermarket that has their bags standing right next to the 12-pack of Value Diapers, or from a shop that specializes in either bags or leather products?

I’m guessing it’s the former.

The same holds through for Amazon businesses, even though it may not be as apparent at first.

While some FBA entrepreneurs take the approach of “I’ll sell anything that the market demands, regardless of what category it’s in,” it’s usually a short-lived approach and one that buyers don’t appreciate.

Not only is it extremely challenging to build a brand around a business like this, but it also comes down to the common belief that if one is trying to be good at everything, they’re likely good at nothing.

Because of this, it’s challenging to find a buyer for your FBA business that sells three cooking pans, two inflatable toys, and a few SKUs of dietary supplements.

Action Item #8: Don’t launch products across multiple unrelated categories. If you already have, consider splitting the business up to different brands and selling them individually.

#9 – Clean Books

Now is where we get to the boring stuff 🙂

Simply put, a messy set of accounts makes even the best business unsaleable. Or it at least leaves it grossly undervalued.

I’m not joking when I say that a difference between a 2x business and a 3x business is often how well its books are kept. And in real terms, that difference often translates into hundreds of thousands of dollars.

So, what should you do? A few easy things.

Step One – Hire a good accountant.

Sure, a decent accountant will charge you upwards of $1,500 a year. But if you ever want to sell your business, I promise you that this $1,500 will translate into a much more significant sum in your pocket in an increased valuation.

Oh, and your mother-in-law, who happens to do book-keeping for some other businesses, is NOT an option you should ever consider. Similarly to how you prefer having your tonsils removed by a professional surgent, rather than a friend who’s seen a scalpel once or twice, you’ll want your FBA books to be done by a professional accountant with experience in similar businesses.

Step Two – Stop Expensing Your Lunches and Vacations

While most buyers are fine with small business write-offs and tend to ignore them in their valuation decisions, some are not. Similarly, while the buyer may be happy with your $20k Hawaii holiday being written off as a business expense, the buyer’s lender will almost certainly not be.

Because of this, the simplest solution to avoid potentially significant issues down the road is to avoid writing off non-business expenses altogether, at least during the 12-24 months leading to the sale of the business.

Step Three – One Business, One Bank Account, One Entity

It may be tempting to run multiple businesses through a single entity. You’ll save some money, there will be just one tax return each year, and your structure will be simpler altogether.

But this approach collapses like a house of cards the moment you decide to sell one of your businesses but keep the rest.

It’s certainly possible to de-mingle a set of comingled books, but it’s never clean and can prevent your buyer from obtaining bank financing. And not being able to get funding often leads to lower deal value.

Action Item #9: Hire a professional accounting firm. Ideally, from the moment your business becomes profitable.

#10 – Outsourced Day-to-Day Work

Most of the Amazon buyers I’ve spoken to have listed “Accidentally messing something up” as one of their top fears when buying an FBA business. Combine this with the fact that very few people want to pay money for what ends up being a full-time job, and it becomes clear that outsourcing is the way to go.

Don’t get me wrong. I’m not recommending you to outsource everything and reduce your workload to zero. That would be incredibly bad for your profitability, but worse, your business’s growth prospects would suffer a lot.

What you should do, though, is outsource the simple, yet time-consuming stuff. I’m talking about first-level customer support, about anything related to logistics, about data entry. The kind of things that YOU as the business owner shouldn’t be wasting your time on in the first place.

By outsourcing repetitive tasks to freelancers, employees, or 3PL providers, you will not only make the business more attractive to buyers but will also free up more of your time to address the things that really matter.

Outsourcing can be a scary prospect if you haven’t done it before, but it’s not at all difficult once you get going, and you’ll soon thank yourself for doing it.

Action Item #10: Track your time for 30 days to see what you spend most of it on. Then look for ways to outsource the time-consuming but easy tasks to freelancers or third-party service providers.

#11 – Product Uniqueness

As I’m writing this and noticing that we’re at number 11, I’m considering removing the enumeration altogether. That’s because things like product uniqueness don’t deserve to be so far down the list. But I’m hoping most of you will accept that every single one of the 17 items can make or break a lucrative exit.

With that aside, let’s talk about product uniqueness.

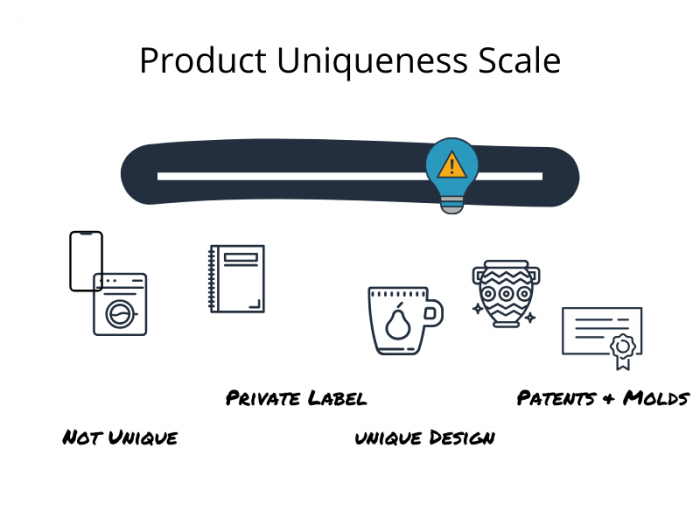

Instead of viewing it as a binary, “unique” or “not unique” kind of a thing, product uniqueness is more like a sliding scale.

On the far left of the scale are products that aren’t unique at all. That would be things like household electronics, chocolate bars, and anything else you’d compete with other sellers for the buy box.

A close second to this are non-unique private label products. Think of a generic set of poker chips that everyone and their dog can (and does) get off of Alibaba, slap their logo on and sell for 30 bucks.

The opposite side of the spectrum is taken up by products that are totally unique, designed by you, or your team in-house and come with design patents and your own molds.

And the middle is taken up by everything else in between – from slightly modified private label products to unique designs sourced from the manufacturer.

As a general rule, the attractiveness of an FBA business closely correlates to the product uniqueness scale.

Nobody wants to buy an Amazon business that sells a product that everyone else can easily access. There simply isn’t any substance to such business, as the prospective buyer can just as easily start selling the same products themselves.

The poker chips example from above is somewhat more attractive, but not much. The additional attractiveness stems from the brand potential. While other sellers may sell the same or very similar product, it’s often the brand that matters. Having a private brand also means you can protect your ASINs and don’t have to worry about other sellers competing with you on Amazon.

But there are still significant risks associated with products like that, making them quite unattractive in general.

What most buyers find attractive, on the other hand, are products that have a degree of uniqueness to them. It can be an existing product that you’ve asked your manufacturer to improve just for you. Or something that was designed from scratch based on your instructions. Or it can be the result of a product development process that’s entirely under your control.

In general, though, the more your products can be protected against the competition, the better your business is going to do on the market.

Action Item #11: Put yourself in the buyer’s shoes and ask: “How easy or difficult would it be for a competitor to drive me out of business or seriously hurt my sales?” If you’re not happy with the answer, work on improving your product portfolio before considering an exit.

#12 – Off-Amazon Potential

It’s probably no surprise that the biggest risk of running an Amazon business is, well, that it’s an Amazon business 🙂

It may not be a big deal when you’re starting out, but grow the business beyond a certain point, and the dependence on Amazon becomes an issue. Once significant earnings, everything you’ve built, and your employee’s livelihoods are at stake, the prospect of Amazon having the power to drive your business into the ground immediately is quite scary.

Because of that, the potential to expand the brand outside of Amazon is often incredibly important and can add significant value.

But let’s not confuse real potential with dreams.

Frankly, I can’t remember the last time I spoke to an Amazon seller who told me that their business doesn’t have off-Amazon potential. The reality, though, is different, and these off-Amazon dreams often get shattered the moment they start being pursued.

Because of that, what matters is only real potential that you can demonstrate.

Do you want to convey the message that your business would be able to get sales through its Shopify store, marketed with Facebook ads? Then launch the store and kick off the ads. Show your prospective buyers that it’s possible, and they’ll believe you.

Or perhaps your USP is that your brand is the kind that Walmart, Target, and Best Buy are all desperate to stock, if only you had the funds for the extra inventory? It’s unlikely. But if you put some energy into networking, reach the right people and get a retailer to show you some actual interest, it’s a very different story.

You get the point. Words are worth nothing, but even a little bit of progress and proof will go a very long way.

Action Item #12: Brainstorm different ways to diversify your business into non-Amazon sources. Then figure out 1 or 2 that you can demonstrate without breaking the bank.

#13 – Bearable Seasonality

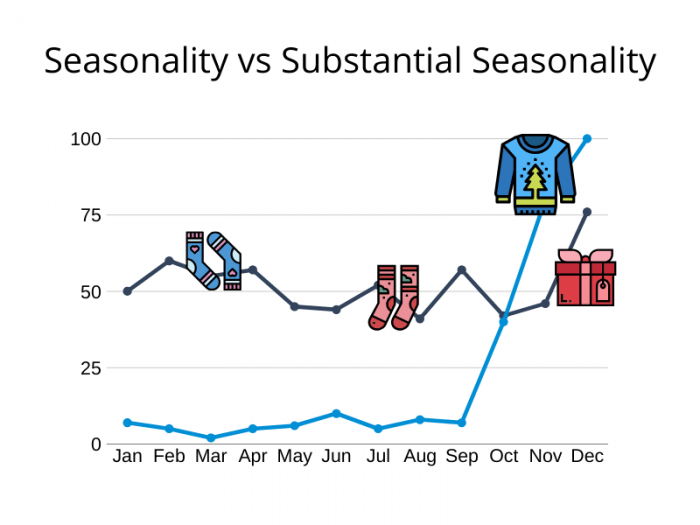

Nearly every business is somewhat seasonal, and that’s OK. No-one is going to devalue your FBA store because of a 20% increase in sales in December.

But there’s a difference between seasonality and substantial seasonality.

If your business sells next to nothing all year, only to make most of its revenue over the holiday period in December, then you have a problem.

A good test is to consider what would happen if you run out of stock for an entire month during your “high season.” Would your business survive? If so, you might be OK. But if this one stock outage would result in significant disruptions and changes to your business model, then you’re dealing with a heavily seasonal business that will be valued very differently from its non-seasonal counterparts.

Granted, some product categories just are seasonal, and there’s nothing you can do about it. You can try to sell Christmas trees in May or sunscreen in November all you want, but the odds are that your efforts will turn out to be fruitless.

And that’s OK. You’ll just need to realize that the market value of a seasonal business is much less than the overall median. The risk of a simple hiccup being detrimental to the whole year’s performance is simply too high for buyers to pay a premium.

Something you can do, though, is introducing new products that are either less seasonal or have a different high season.

Say your store specializes in Christmas cards. The apparent expansion avenues then would be Valentine’s day cards, Mother’s day cards, or even generic birthday cards. A business that sells sombreros could launch some winter hats. You get the gist.

Action Item #13: Apply the “seasonality test” to your business. If you fail the test, decide if you’re ready to accept a 40-60% lower-than-average valuation, or would instead try to de-seasonalize the business.

#14 – Protection

When doing business on Amazon, trademarks, and patents are an incredibly valuable form of protection.

While getting your products fully patented wouldn’t be possible for most, getting a trademark registered is something nearly every seller can and should do.

Having a simple trademark in place for your brand name gives you two main benefits:

Firstly, it will protect your brand from “listings hijacking.” If you don’t know what listing hijacking means and haven’t experienced it, then you should consider yourself lucky. In short, it means that a predatory seller comes up with a product similar to yours and starts selling it under your ASIN, but at a lower price. In practice, this means that you will lose nearly all of your sales for that product overnight.

As a trademark owner who’s in Amazon’s Brand Registry, all you have to do is submit a report, and Amazon will kick the predatory seller right off your listing – it’s as simple as that. But without a trademark, there’s virtually nothing you can do. That’s how important this is.

Secondly, Amazon’s Brand Registry 2.0 is only available to sellers who have a registered trademark, and it offers far more than brand protection. From custom brand pages to better search and report tools, it’s something every seller needs to have.

And the best part of it all? Registering a trademark will set you back only $300-$600 in most cases – a small price to pay for the protection that it gives you!

Action Item #14: If you don’t already have your brand name trademark, contact a trademark attorney today and get the process started. There will be some waiting time involved, so start early!

#15 – The Right Number of SKUs/ASINs

A significant consideration for many buyers of FBA businesses is the number of products that the business sells.

While there is no right or wrong answer, or a magic number that just “works”, you will want to avoid either of the two extremes.

Having too few products creates a risk

It probably doesn’t come as a surprise that a business that is dependent on a single product (or two) comes with a bucketful of risk. After all, should anything happen to the product’s supply chain or its Amazon listing, the whole business will suffer a lot.

For this reason, many buyers actively avoid looking at FBA businesses that have either just one or two products, as well as ones that have most of their revenue originate from one or two products (which, in reality, is the same).

Some buyers are happy to assume this risk, such as groups that operate a portfolio of businesses. For these buyers, the “single SKU risk” would be hedged the moment they take over the business. But it’s worth noting that these groups know what the market is like, and will therefore still take the lack of a sufficient product portfolio into account in their valuations.

An extensive product portfolio is hard to manage

While having too few products is considered risky, “the more, the merrier” isn’t the solution, either.

That’s because an incredibly broad product portfolio requires a lot of management, and in many cases, a lot of operating capital to be deployed for inventory.

Even if all of these products originate from the same supplier, there will be the question of handling customer support, tracking metrics, dealing with price changes, and more.

For this reason, buyers typically consider businesses with several hundred SKUs less attractive than those with a few dozen.

In an ideal world, your product portfolio will be well-balanced, with a handful of strong products, each clearly contributing to the business’s revenue.

Action Item #15: If you have less than three products, or if 1 product represents over 70% of your sales, begin research on new products. If you have over 50 products, do a thorough review to see if you can kill the losers and double down on the winners.

#16 – The Right Amount of Inventory

Inventory is another area where too much and too little are both bad. Unfortunately, there’s no one correct answer, and only you will be able to determine where the optimal point is.

You’ll want to make sure that your business always has the necessary inventory levels to withstand a delivery issue or an unexpected spike in sales. At the same time, you definitely shouldn’t put all of your free cash under inventory and stock yourself up with a full year’s worth.

The implications of having too little inventory are quite obvious – it’s the additional risk, for the most part. While that isn’t something that would necessarily have a direct impact on your business’s valuation, it’s a risk that you’re taking yourself. Running out of stock within 12 months before selling the business can be detrimental to the valuation.

But let’s talk about having too much inventory, as that’s something that does have the potential to influence your valuation.

As a general rule, you should be aiming to have no more than the amount of your yearly net income stuck under inventory at any given time.

So if your business generates $100,000 a year after Cost of Goods, Amazon fees, and operating expenses, the landed cost of at-hand inventory should never exceed $100,000. If it does, you’ll likely see a lower valuation, as buyers will be hesitant to put such a high percentage of earnings into working capital.

It’s a delicate balancing act, though. On the one hand, you’ll want to ensure that your inventory levels don’t exceed your net profit, but that can’t be at the expense of reducing your inventory levels to where they don’t make sense.

A lot of it is also dependent on your business model. If you’re selling 2-3 private label products, then how much inventory you keep is mainly up to you and how well you can negotiate with your supplier. But if your product portfolio is hundreds of SKUs, then you may have less flexibility.

Action Item #16: Calculate the % of your yearly net profit that the landed cost of your at-hand inventory represents. If it’s more than 100%, see if you can cut it down.

#17 – Stability

Let’s make one thing clear. When I say stability, I don’t mean financial stability. While financial stability is also essential, we already covered that in the “Growth” section above.

By stability, I mean operational stability. In other words, no recent changes in the way your business works.

I’ve covered a lot of it already in my recent write-up, titled What NOT To Do Before Selling Your Amazon Business, but let me summarize in 2 points.

- Making significant changes to the business within the 12 months leading up to the sale is not good.

- Making any operational changes within the three months leading up to the sale (or while the business is listed for sale) is really, really bad.

That’s pretty much all there is to it.

For the “why” part of it, check out the article that I linked to above. In short, though, buyers love stability and hate surprises. For this reason, any changes that have the potential to impact the business are best made long before selling it. This way, buyers can be confident that the changes didn’t have any unintended negative impact.

Action Item #17: Decide your ideal “sell date” and schedule any operational changes to at least 12 months before that date.

Bottom Line

So there we have it!

I had lots of fun putting this together and hope you had as much fun reading through it all. More importantly, I hope these tips will help you increase (or realize) the value of your FBA business, once the time is right.

What I can say for sure is that those of you who can give it 12 months or more, and take the above tips seriously are almost 100% certain to increase the valuation of the business. Even if most of it doesn’t apply to your specific scenario (it rarely does!), there are almost certainly some bits that do.

But remember – you can “hack the system” as much as you want, but ultimately, fundamentally sound businesses that provide real value will always sell at high multiples, while fly-by-night “opportunistic” operations will find it hard to compete. Keep this in mind when building your next FBA business, and it will be hard not to succeed!