Selling a business is often compared to selling a house. Many people believe it’s mostly the market that drives the prices up and down, and little to nothing can be done to increase the value of a business yourself. In the short term, anyway.

The reality couldn’t be further from the truth. While the market does drive multiples, it’s actually been very stable for Amazon FBA businesses for many years. But for some reason, we still see businesses selling for multiples from as low as 1x to as high as 4x SDE. (Related: The Most Important Metric to Understand: SDE).

Why is that?

Put simply, with real estate, around 80% of a house’s value is driven by things you can’t change – mostly the market conditions and the property’s location. The remaining 20% comes from things like its condition, how well it’s marketed and other things that are somewhat under the owner’s control.

With businesses, the situation is very different indeed. With no location to speak of, the majority of the value of a business is driven by things that are directly under your control.

How much money the business makes has the biggest impact by far, but there are several other things one can do to significantly increase the value of an online business. Some of these things need more time and effort while others are easier to tackle.

Here are the Top 8 ways one can go about increasing the valuation multiple and the “saleability” of an Amazon business in 2023.

Tip #1 – Make Sure Your Business is Growing

When selling your business, timing is everything.

Sell too early and you’ll end up shooting yourself in the foot. Leave it for too late and you’ll risk going into a decline.

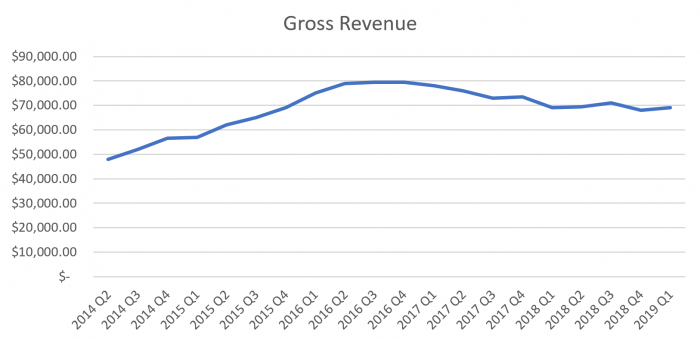

Looking at the above graph, it doesn’t take a genius to figure out that from the seller’s perspective, the best time to sell would be in Q2/2016, as this is where the business “topped out”.

Unfortunately, revenue graphs like this are great at showing us we’re too late and should’ve sold earlier, but this isn’t really the information we’re looking for. What we really want to know is whether the right time is now or at some point in the future. And if it’s in the future, how far in the future!

So how do we tell if it’s the right time?

It’s probably not surprising that there really isn’t a black-and-white answer. While you certainly want to be selling while trends are on the up, you don’t want to leave too much on the table, considering you’ll be paid for your past performance, not for the future opportunities.

Let’s say your earnings in 2017 were $100k, in 2018 increased to $200k and in 2019 another 100% increase to $400k. If you were to sell your business in the beginning of 2019, it would be priced based on the 2018 earnings. This means that the 2019 projections won’t put any money in your pocket and you’ll end up losing out significantly.

But, on the other hand, if you were to hold on to the business for the whole of 2019 and it didn’t perform as you expected, going into a decline instead, your valuation would go down by a lot. That’s because what used to be a growing business is now a distressed asset.

Because of this, there isn’t a clear answer here and a lot of it comes down to the level of confidence you have in your projections, as well as your risk tolerance.

Generally speaking, though, you’ll always want to capitalize on any quick and easy growth opportunities, making sure you bring them to life, having them add to your bottom line. It’s the bigger and more time-consuming things you can leave to the new owner. This way, you’ll be able to reach your exit relatively quickly while the new owner will still have growth opportunities left for themselves as well.

But whatever you do, take good care of not going into a decline. Growth trends are one of the primary drivers behind a business valuation and the difference between a growing business and a declining one is like that between a brand new BMW and a rundown Honda Civic.

Tip #2 – Avoid Going Out of Stock

I’ve analyzed several hundred Amazon businesses over the last few years. I’ve seen a lot of great businesses, even more not-that-great ones and many businesses that could be really good but for one reason or another, aren’t.

The number 1 reason why a business ends up in the “could-be-great-but-isn’t” category is that it has run out of stock at one or more occasions over the last 12 months.

You probably know by now that valuations are mostly done by looking at the trailing 12 months’ revenue and profit. With this in mind, having a huge dip due to going out of stock always has a severe negative effect on the valuation.

Some sellers and brokers try to get past this issue by “modelling back” the revenue that the business would’ve generated had it not run out of stock. While this approach may make sense at first glance, in the real world it rarely does, as this is not how buyers look at things. I have a large number of first-hand examples to prove that these cases almost always result in a significantly reduced valuation.

And all of this is only the direct impact of the stock outage. In addition, we’ll have to look at the knock-on effect that it’s going to have on product rankings and the slow-down of the overall growth curve. My direct experience with these businesses has shown that, in most cases, it takes up to 4 months to fully recover from a single stock outage.

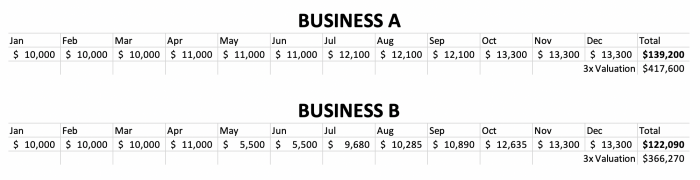

To illustrate, let’s look at the two examples below:

As you can see, the first example (Business A) depicts a healthy business that is growing at around 10% per quarter.

Business B is the exact same business, but with the exception that it had a 1-month stock outage, lasting from mid-May to mid-June.

At first glance, it would seem that the “cost” of the outage was only $11,000 ($5,500 in May and $5,500 in June). But the reality is quite different, as we need to look 2 levels deeper. The “levels” that we have are:

Level 1: Direct Cost (Loss of Revenue): $11,000 as discussed.

Level 2: Knock-on Effect: As it can take 4 months to fully recoup the sales and rankings, the $11k actually increases to $17,110 (the difference between the yearly totals of Example 1 and Example 2)

Level 3: Valuation Multiple: Since a business valuation is nearly always a multiple of the trailing 12 months earnings, the same multiple would also apply to these losses. Let’s assume that we were to sell the above business and that its valuation multiple would be 3x (a fairly standard multiple). We’d then see that the valuation would come to $417,690 in the first example, but only $366,270 in the second one. That’s a difference of a whopping $51,420 – a long way from $11,000!

Bearing all of this in mind, it becomes clear how extremely important it is to do everything in your power to avoid running out of stock. If that means risking a little bit more of your money by ordering more inventory in advance then so be it — the benefits will be worth it.

Tip #3 – Don’t Over-Optimize Your Taxes

As business owners, we all want to do as much as we can to make sure we pay the least amount of taxes the law allows us to. And this is perfectly fine, as long as everything is legitimate.

But even then, many tax-optimization strategies have a hugely negative impact when the time comes to sell the business.

I’m talking about tax write-offs that aren’t necessarily very obvious at first glance. Because of this, these write-offs have the potential to hurt either your business’s valuation directly or the buyer’s ability to obtain financing (which, in turn, hurts the valuation).

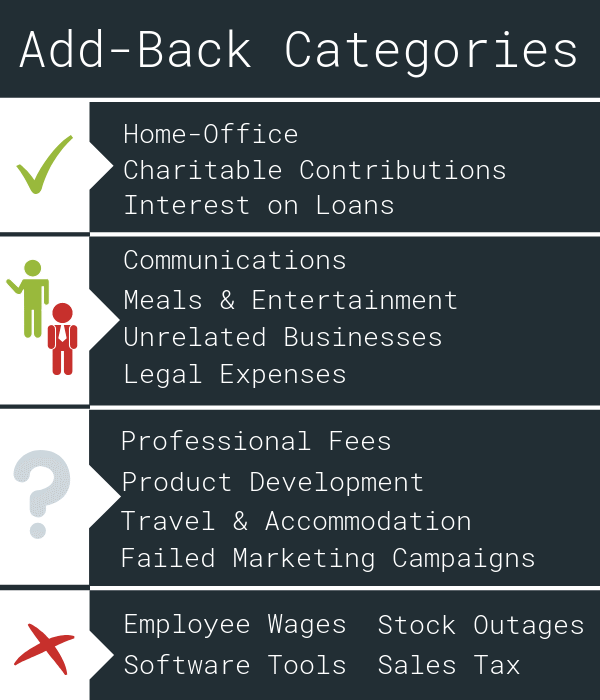

When it comes to tax write-offs or add-backs, they can be loosely assigned into four distinct categories:

Category 1 – Acceptable to Everyone: These are the add-backs that are so straight-forward that no buyer, broker or banker is going to have an issue with them. An example would be writing off the owner’s home-office. It’s clear that this is a (legitimate) tax write-off of an expense that the new owner will not incur.

Category 2 – Acceptable to Buyers, but not Bankers: This is where things start getting more complicated. We’re now talking about add-backs that, when applying a certain dose of common sense, brokers and buyers are mostly happy with, but it doesn’t mean that lenders are.

The best example is usually the Meals and Entertainment line item. To the buyer of an online business it’s pretty clear how much of this is actually needed to run the business (typically none). But as there are usually a lot of expense rows under the line item, a lender could not feasibly verify each and every one of these and, therefore, many lenders simply choose to not accept this line-item as a valid add-back.

Category 3 – Grey Area: These add-backs are a grey area to everyone involved, and as a seller, you can expect them to be scrutinized by the broker and the buyer, and likely completely discounted by a lender. An example would be any “partial add-backs”, e.g. Travel and Accommodation where half of it was business travel and the other half personal.

I also often see sellers trying to claim some failed marketing campaigns as add-backs, which is also rarely a good idea. Generally speaking, this category involves everything that isn’t as straight-forward as looking at the expense documents and being able to tell, with a 100% certainty, that the expense in question is an add-back.

Category 4 – Not an Add-back: Finally, we have expense items that simply aren’t add-backs, regardless of what angle you look at them from. Examples would be stock outages (discussed above), employee wages (the argument that the new owner can choose to get rid of the employees is not a sound one), any taxes that the buyer would also incur and other expenses in that vein.

While Categories 1, 3 and 4 are typically quite straightforward (with a good broker, at least), it’s Category #2 that creates a lot of issues and, to make matters worse, these issues often come up at the 11th hour, potentially jeopardizing a deal.

This is because brokers and sellers often take a very different approach to add-backs than lenders. The buyer of your business is likely to have the time and energy to actually dive into your expense rows and clarify what doesn’t make sense at first glance, but the lender rarely does – resulting in situations where something that could be quite easily “explained away” isn’t even going to be taken into consideration.

Because of this, it’s a good idea to avoid anything that doesn’t fit in Category 1, at least during the last year leading up to the sale of the business. You can always open up a new entity and transfer your non-related expenses there. You’ll be doing yourself a big favor.

Tip #4 – Clean Up Your Books

If you asked me for the most common reason behind deals falling through at the last minute, I’d say “messy accounting” without hesitation.

A FBA business’s books can be messy in many different ways, but in most cases, it comes down to the combination of:

- Not using proper accounting software

- Having your accounting cash-based, not accrual

- Counting all Amazon payments as “gross income” without a breakdown

- Lumping too many items together in a single line-item

- Co-mingling different business’s income or expenses

- P&Ls and Tax Returns not adding up

Let’s take a minute to look at each of these individually and what can be done to avoid or fix these issues.

Not using proper accounting software

These days, online accounting software like QuickBooks Online and Xero is super cheap (not more than $30-$40 a month in most cases), easy to use and really powerful.

This means that regardless of whether you have a bookkeeper or not, there’s virtually no excuse to still use Excel for your accounting. Switching to accounting software will save you a lot of time and make the selling process a lot easier.

A lot of issues in the due diligence phase of an acquisition stem from inaccuracies in the business’s accounting. These inaccuracies come easily and in large quantities when proper accounting principles aren’t being followed.

And issues in due diligence are something you want to avoid like the plague, as this is the kind of stuff that has you settle on a bargain at best or kills the deal altogether at worst.

Having your accounting cash-based, not accrual

I’ve written about the importance of having accrual accounts before (Related: Cash-Based Accounting – The Easiest Way to Undervalue an Amazon Business), but will briefly mention it here to stress its importance.

In short, all you need to know is that if your company is growing, cash accounting will show lower profits than accrual accounting would.

As being able to show lower profit is often preferable from the tax standpoint, it may make sense to maintain the “main” set of accounts on a cash basis, but in these cases, you need to always make sure to also have accrual accounts available in parallel.

This is because lower profit results in a lower valuation and a lower sale price. It’s as simple as that.

Counting Amazon payments as “gross income” without a breakdown

Using good accounting software is, unfortunately, only half a solution. You (or your accountant) will also need to use it properly.

A big mistake that I often see is only counting the payments you receive from Amazon as “income” and not breaking down the FBA fees, returns and the many other line items that Amazon provides.

Unfortunately, this isn’t an issue that only those who keep their books themselves have. Plenty of less competent or lazy accountants tend to do the same, and when it comes to selling your business, it can quickly turn into a fairly major issue.

But why is it an issue in the first place?

For many reasons. Not only does the lack of this breakdown not allow the potential buyers to see your return and refund rates, Amazon fees and more, doing it like this often completely skews all margin calculations. Many of the expenses that Amazon deducts before paying you, fall into the negative Income or CoGS categories, which interferes with Gross Margin calculations, but this isn’t even the biggest issue.

The biggest issue by far is things like Advertising Expenses (Amazon PPC), which actually fall under Operating Expenses, so even further down your P&L, meaning that your Net Margin will also be off.

In short, just don’t do this or if you have an accountant who does things this way, do yourself a favor and take your business to a more professional and knowledgeable one.

And speaking of accountants – NEVER, EVER have your books done by an accountant who’s a friend or a family member. I’m yet to see this ever being a good idea.

Lumping too many items together on one line-item

When it comes to presenting your financials, clarity is the key.

Picture yourself buying a car. You’ll probably want to know not only what the car looks like from the outside, but also what engine it has, whether the breaks work and how much fuel it consumes.

Similarly, the buyers of your business will want to know more than just the headline numbers of how much revenue and profit the business generated last year.

And it’s not just curiosity and due diligence, either. Many buyers are able to justify paying a higher price due to seeing opportunities to reduce expenses. But for this to happen, these expenses have to be broken down in the first place.

To illustrate this, to you as the business owner it may be perfectly fine having a single expense line-item called “Office Expenses” as you know by heart that this includes your rent, cell phone, office supplies and Internet connection, and you always have a rough idea how much each of these things cost.

But the buyer will have no such overview and may assume something completely different.

With this kind of line items, especially when the amounts are relatively small, buyers may not even question them and will just rely on assumptions. But this is bad news to you as these assumptions can easily result in missed opportunities, ending up with you getting lower offers than you would otherwise.

Co-mingling different business’s income or expenses

While not exactly an accounting error, but rather a business decision, co-mingling multiple businesses in a single entity is always a terrible idea when it comes to selling a business.

Being a serial entrepreneur myself, I fully appreciate the urge to do so at times. Who wants to go registering a new company every time you want to do a simple test on a new business idea!

But this is something you’ll do yourself a huge favor avoiding if your intention is to sell your business in the next year or two.

That’s not only because co-mingled financials are a due diligence nightmare, increasing the chances of a deal falling through, but because virtually no institutional lender will work with a business that has co-mingled accounts. They simply lack the capacity to verify the broken-down accounts to determine the income and expenses really related to the business being sold.

And buyers not being able to obtain a loan to buy your business will significantly reduce the pool of buyers available to you, which in turn reduces your business’s valuation.

Don’t get overly scared, though – common sense still applies and no-one is going to penalize you for having a single $1,000 expense a year ago that was clearly not related to the business you’re selling. But if these expenses occur often and/or are large, you have a problem.

As with nearly everything accounting-related, the longer you’ve done something “the right way”, the better it is, but with this and many other tips, your first priority should be making the last Financial Year nice and tidy. While prior periods are still important, they’re not AS important and likely won’t influence your valuation as much.

P&Ls and Tax Returns not adding up

Let me begin by saying that as long as you’ve been following the above tips, this one shouldn’t be an issue at all.

But I still keep seeing businesses with healthy-looking Profit & Loss Statements and/or Management Accounts, but Tax Returns that paint a completely different picture.

This can happen for a variety of reasons. Usually, it’s the case of co-mingled accounts, excessive add-backs or incompetent accounting, but sometimes it happens because of last-minute re-classification and for other reasons.

The bottom line is that you need to do your best to have your P&Ls and your Tax Returns match as closely as possible.

As with above, this is both a potential due diligence issue (buyers will want to check our tax returns), but more so, it’s a lending issue because while buyers tend to look primarily at your P&L and verify using tax returns, lenders work the other way around and make their lending decisions primarily by the numbers that you’ve filed to the authorities.

Tip #5 – Don’t Launch New SKUs

I have to begin this tip with a caution to not take it word-for-word. Let me be clear – if you’ve been launching a certain number of SKUs each year/quarter/month, you should absolutely continue doing it. Buyers appreciate stability a lot. Because of this, “keep doing what you’ve been doing” is always good advice.

What I mean by my suggestion to not launch any new SKUs is to not take on any costly expansion projects within 6-12 months before you intend to sell the business.

Why? Because it will almost certainly hurt you financially.

We’ve discussed before how valuations are usually done by applying a certain multiple to your trailing 12 months figures. Keeping this in mind, let’s think about what happens to both revenue and expenses when launching a new product:

- It usually takes from 3-12 months for the revenue side to fully pick up. This means that the new product will only reach its full potential (from the valuation perspective) after 15-24 months! That’s a long time.

- While you’re not getting the full benefit, you are getting penalized for the launch, as most product launch costs are incurred upfront and buyers are often very hesitant to consider these costs add-backs.

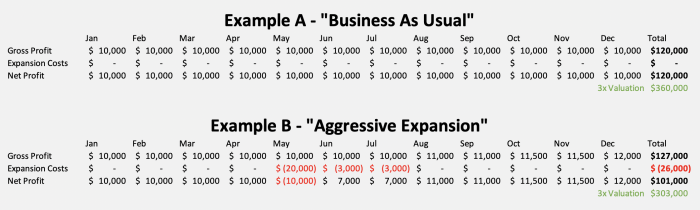

Take a look at the below example, illustrating the difference between launching and not launching a new product.

The examples above assume that it costs $26k to launch a new product and the product will start generating revenue gradually, reaching its full potential in about 6 months’ time.

While the product launch costs themselves will be recouped in less than a year, as you can see above, from the valuation perspective, it takes much longer than that.

That’s because the product launch costs won’t be amortized in line with the revenue generated by the new product. Instead, the launch costs will affect the whole of the trailing 12 months period.

In simple terms, this means that you will only get the full benefit of the new product once it’s been selling at full capacity for a whole year! Up until that point, you’d essentially be losing money.

So while you may think that it’s a good idea to “prove your expansion opportunities”, this only applies if you have sufficient time to not only see the new products reach good sales volume, but to then wait it out until they’ve been selling at that volume for a full 12 months.

If you don’t have such time, it’s often much better to simply not do it. What you can do instead is any initial prep-work, so that you can show buyers how you’ve done the research on new products and all they need to do is take your plans and bring them to life. This won’t have a direct impact on the business’s valuation but it does increase the amount of goodwill and makes it more likely that you end up with a good offer for your business.

Tip #6 – Avoid Big Changes

The same that we talked about above in the context of launching new SKUs actually applies to nearly everything else as well.

As a general rule, you’ll want to avoid making any major changes to the business in a certain period leading up to the sale. This is because buyers appreciate stability a lot. As the seller, you’ll want to do everything in your power to show as much of it as possible.

Wait a minute. “A certain period” ???

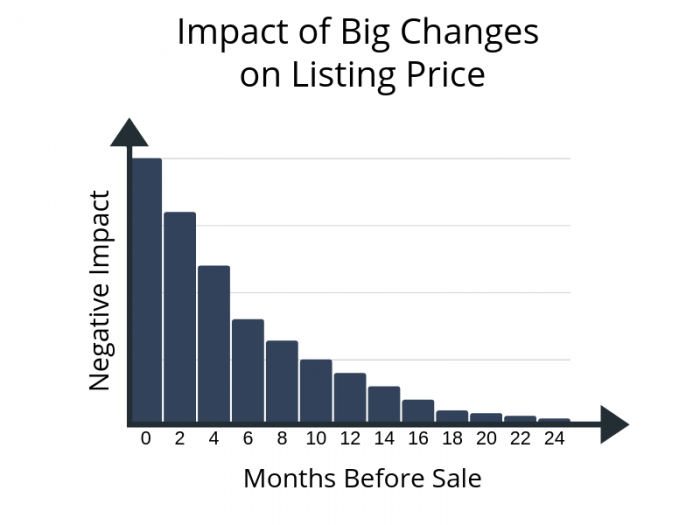

I realize that is is super vague, but it’s so for a reason. When it comes to how much do recent big changes influence your business’s attractiveness, it depends largely on how recent those changes are.

Think of it like a sliding scale.

Let’s say you decided to switch your manufacturing from China-based suppliers to US-based ones. If you made that decision a month before selling the business, it would have an enormous (negative) impact. If it was 3 months before, the impact would be slightly less. If it was 9 months ago, it would be largely fine but still present a few issues. If it was over a year ago, there would be no issues.

I’ll add just a tiny bit of complexity to it, though. As the above graph illustrates, the scale is actually exponential, rather than linear.

As you can see, there’s a HUGE difference between making a big change 1 month before the sale vs. 6 months before, but from there on, the size by which the impact decreases each month starts going further down, until it becomes more or less stationary at the 18-months mark and completely disappears at 24 months.

What kind of changes are we talking about, anyway?

It’s all nice and well to talk about not making big changes and buyers appreciating stability, but we also need to look at what kind of changes actually fall under it.

As you can imagine, it wouldn’t be feasible to not touch the business at all for 18 months leading up to the sale. In fact, it’s quite the opposite – do this and I can almost guarantee you that the business won’t do well on the market.

What I’m mainly talking about avoiding here are one-off changes that are outside of the normal course of running the business.

Here are some examples of both these categories:

DO:

Keep Ordering Inventory

Manage Ad Campaigns

Develop Products as Usual

Run the Day-to-Day

Talk to Your Staff

Pay the Bills 🙂

DON’T:

Change Vendors

Hire or Fire Employees

Make Big Investments

Enter New Markets

Change the Business Model

As you can see, things like optimization of ad campaigns fall into the left column. These are the “changes” that you should be making constantly and the 6, 12 or 18 months leading up to the sale aren’t any different.

Conversely, things like switching Vendors and replacing employees are best avoided, as these are the kind of changes that trigger uncertainty, and the buyer being uncertain about the future of the business is something you’ll always want to avoid.

And then there are things like launching new SKUs that fall into both categories. There, it depends largely on what your business’s day-to-day has looked like so far.

If you’ve been launching 50 SKUs a year for 3 years then buyers would expect you to keep doing the same up until the very day the business gets sold. But if you haven’t launched a single new SKU in 3 years, you shouldn’t launch one just a few months before the sale either.

You should, of course, not take any of this as a black-and-white rule. If you find that an employee has been stealing from you, by all means, go ahead and fire them straight away. These “rules” are a good guideline but common sense still needs to prevail.

Tip #7 – Don’t Neglect The Business

To many people, this one falls in the “common sense” category. But you’d be surprised how many business owners completely neglect their business the moment they’ve decided to sell it.

The serial entrepreneurs among us enjoy spending time on new and exciting projects and tend to pay less attention to the “old and boring” ones. Often, having a new and exciting venture in the pipeline is the very reason a business is sold in the first place.

But concentrating your efforts on the new shiny object is one of the worst mistakes you can make when intending to sell your business.

I feel like a broken record here, but the “do whatever you can to project stability” rule applies here, too.

When selling your car, would you consider leaving it standing around in the rain, unmaintained and not taken care of, and still expect someone to pay a premium for it? I’m guessing not.

The same applies to businesses. Every buyer can smell a neglected business from miles away, even if it’s not immediately obvious from its financial performance (it often is). The result? Significantly lower buyer interest, which results in a much lower valuation.

Being an entrepreneur myself, I understand the appeal of putting most of your time and effort into the new and exciting venture. But it ultimately comes down to making a decision that’s financially sound.

Many people seem to think that selling a business is an extremely long and complicated process. In reality, a good broker will see the sale of your business through from A-Z in about 3 months.

Keeping this in mind, would you still make the decision to neglect your business if the “gain” is a few hours a day for just 3 months, but the loss is a potentially huge amount of money … often into 6 or even 7 figures.

If you want to maximize the value of your business, do all you can to keep things the way they’ve always been. Your buyers will love it and this will help ensure you’ll see healthy purchase offers.

Tip #8 – Know What Your Business is Worth

Finally, the tip that’s probably the most important of all – you should always have a good idea of the true market value of your business. If you don’t, prepare to lose a lot of money, time or both.

“Wait, this doesn’t make any sense. Won’t the business sell for its fair market value regardless of whether I happen to know it or not?”

Not quite.

Most of you reading this will end up getting a valuation from a business broker, and will then use the same broker’s services to list the business for sale.

While there’s absolutely nothing wrong with this approach, doing just this leaves you extremely vulnerable to both under- and over-valuation.

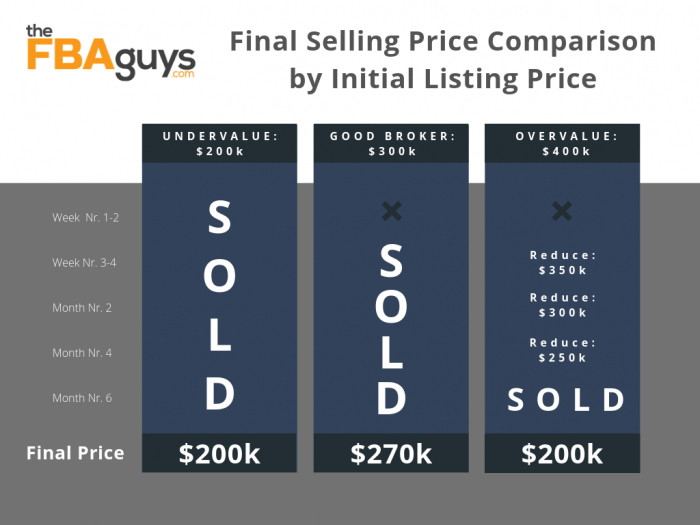

The end-result of under-valuation and over-valuation is largely the same – less money in your pocket. But how it happens differs a bit so let’s look at the two scenarios individually.

Under-Valued Businesses

Many brokers, especially those that are just starting out and don’t have an established buyer base, systematically under-value the businesses that they list.

While some brokers do it out of sheer ignorance and not knowing what the market will pay, many others do it either to make their listings more attractive than those of their competition, to achieve a quicker sale and a higher chance of generating a commission, or both.

Whatever the reasons – the result is always the same: less money in your pocket.

Let’s face it. No buyer is (almost) ever going to offer you an amount higher than the asking price that your broker sets. There are some exceptions to this but these are few and far between.

Over-Valued Businesses

This may seem the more innocent of the two valuation “blunders”, but in reality, it’s both more dangerous, as well as more malicious.

While under-valuations often happen due to the broker not knowing any better, over-valuations are almost always malicious in nature. And unfortunately, there are several such brokerages around, even some firms that are pretty well known.

So why do brokers over-value businesses and how is it bad for you – the seller?

The “why” part is simple – a fraudulent broker over-values your business to get you to sign with them over their competition. This is usually accompanied by a nice and smooth story about how “their buyers” pay more than their competitors’ buyers. This is, and I’m not even looking for a better term, absolute horse-shit. Not most of the time, but 100% of the time.

As for how it affects YOU – this is a bit more complex.

One would assume that if a broker over-values the business then the market will quickly speak up and you as the seller will still end up getting offers around the fair market price figure – the same that you would if the business was priced correctly from the beginning.

But it’s not nearly as nice and simple.

In reality, these over-valued businesses usually end up getting FAR LESS buyer interest than businesses that are valued accurately. This is because many buyers don’t want to waste their time pursuing opportunities that are clearly over-priced.

Think about it. If you were looking to buy an apartment for $500k and saw one that’s listed for $900k … would you go through the hassle of arranging a viewing, researching the area and more, only to put in an offer that’s nearly half of the asking price, for the off-chance that the seller knows their apartment is over-valued?

Some people do that, but most don’t.

What will end up happening instead is a lot of time spent with minimal to no buyer interest, after which the broker will recommend you to reduce the list price to generate more interest.

And here’s the catch – the recommended reduction is almost always to a figure lower than the fair market value.

In essence, the “over-value scam” has turned into an “under-value scam”.

I realize that this sounds like something taken from a very bad fantasy-novel (if there’s a fantasy novel about business acquisitions then it’s bound to be bad!) but I assure you – this happens very often. I talk to people who have been taken advantage of using these tactics every single month.

Oh, and you’re not safe even if you decide to self-represent. In this case, it’s possible that you accidentally over- or under-value your business and you’ll end up with the same issues.

So the biggest favor you can do yourself is find out the current, accurate market value of your business. The best part – it won’t cost you any money and will only require a little bit of time.

Step 1 – Start With a (Good) Valuation Tool

As the first step, I recommend you to start with a good automated valuation tool. I say “good” because there are plenty of apps out there that claim to be able to value businesses, but unfortunately, most of them aren’t good for anything other than (bad) entertainment.

And that’s for a good reason – it’s extremely difficult for a computer to calculate the value of a business! I won’t get too deep into the reasons why, but you can read more here – How Can an Online Business Valuation Tool Be Accurate?

Our Amazon Valuation Tool is an exception in this regard – because of the super-narrow scope (the tool ONLY works for Amazon businesses specifically), it is actually surprisingly accurate.

So give it a try. It’s free and only takes about 12-15 minutes.

Step 2 – Talk to Brokers

When you’re getting closer to actually selling the business, say 6 months or so until your planned exit date, it makes sense to start talking to brokers.

The one and only recommendation I’ll give you here is to speak to at least 3 different brokers and have all of them value your business.

Why? Because only this way can you avoid falling victim of the over- and under-valuation scams. Look at it this way – if the Valuation Tool said your business is worth $480k, Broker A said it’s $500k, Broker B that it’s $450k and Broker C that it’s $800k then you can be pretty sure that something funny is going on.

Oh, and all reputable brokers provide valuations free of charge and on a no-strings-attached basis, so there’s no reason not to spend the few hours it takes to talk to several!