Seller’s Discretionary Earnings, Discretionary Cashflow, Seller’s Discretionary Income – call it what you will, this is the most important figure when it comes to the valuation and sale of any business.

If you don’t know your SDE, you have no way of knowing how much your business is worth, period.

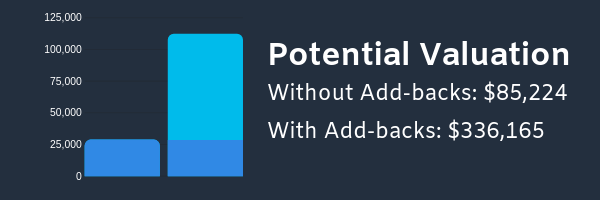

This is because when you hear valuations multiples thrown around – you know, people telling you your business is worth 2.5x or 3x – they’re talking about 3 times your SDE, not 3x your profit, and the difference can sometimes be substantial.

What’s Seller’s Discretionary Earnings (SDE)?

I could quote Investopedia or some other site and copy-paste a complex but accurate definition, but where’s the fun in that. Instead, let me try and come up with a simple one on my own.

In MY words, “Seller’s Discretionary Earnings (SDE) is the amount of money and benefits that a business has generated for its owner over a certain period of time”.

Note the “and benefits” part of this. That’s the important bit as without this, you’d be looking at Net Income. To this effect, here’s the super-simple formula for

(Pre-tax) Net Income + Add-backs = SDE.

That’s literally all there is to it.

Benefits? Add-backs? What’s all that?

I probably don’t have to dive into what Net Income means in the above formula, but the add-backs part of the equation is the more complex (as well as subjective) one of the two.

In essence, an add-back is anything that falls into one of these categories:

One-Off Expenses. Say that you spent $1,000 to have the name of your business trademarked. That’s a valid add-back because it was a one-off expense that the buyer of your business will never recur.

Reversal: What isn’t a one off expense is product launch costs if you’re launching several products once every few years. That’s because these costs are necessary to keep operating the business the same way going forward.

Discretionary Expenses. These are the expenses that are not essential to the business. Perhaps you pay $5k a month for a single-person office on the 45th floor in Midtown Manhattan. This is a discretionary expense as you could easily run your Amazon business from your bedroom instead.

Reversal: While your Manhattan office is a discretionary expense, the office of your employees is not, as they may quit or demand a higher salary should they be relocated to the middle of Bronx after the business is sold.

One Owner’s Salary. When it comes to selling your business, how much you pay yourself for full-time work is irrelevant and, therefore, an add-back. But if you work more than 40 hours a week on the business or have more than 1 full-time owner-operator, anything beyond your own salary will not qualify.

So this is add-backs in a nutshell. Next, let’s look at why they matter.

SDE, Add-Backs & Valuations – How It All Comes Together

Now that I’ve probably sufficiently confused you, I’ll try to turn things around and illustrate all of this with a real-world example that will hopefully draw a clearer picture.

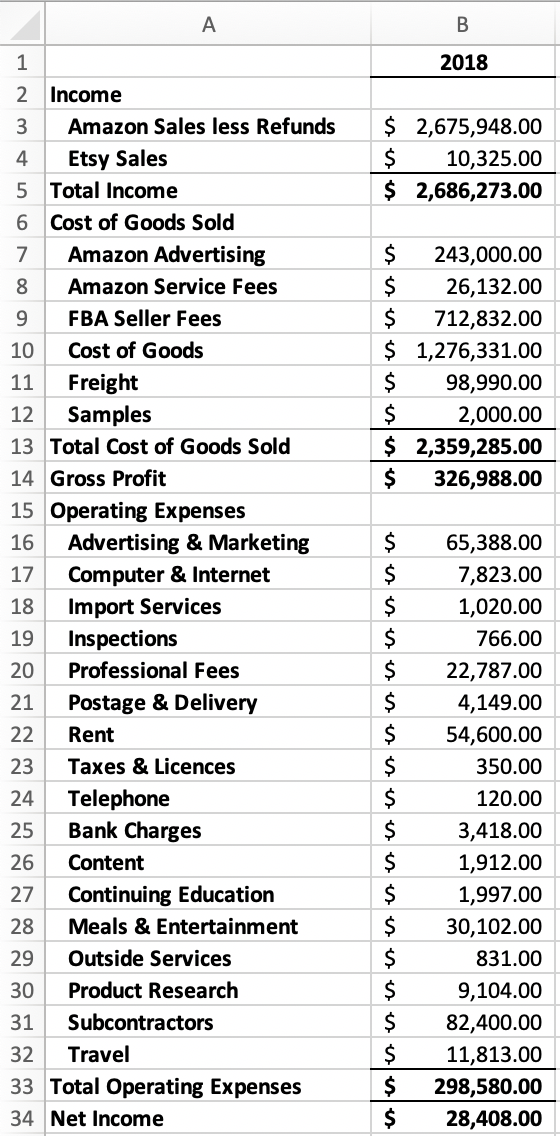

Here’s the (simplified & modified) Profit & Loss Statement of an actual Amazon business that I reviewed recently.

As you can see, the business was only showing $28,000 in Net Income for the whole year. Not a very big business from the looks of it, and definitely a sub-$100k one.

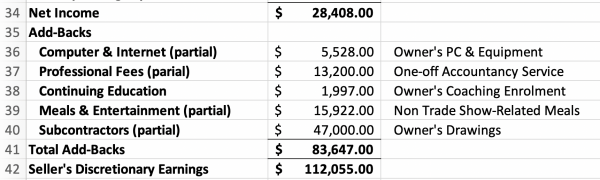

But upon a closer look and a discussion with the seller, it turned out that there were several potential add-backs that we had to look at, namely:

Professional Fees: Out of the $23k, a whopping $13,200 was a one-off accountancy exercise to clean up the company’s books pre-sale.

Subcontractors: While about half of the total amount were truly payments to contractors, $47k were payments to the seller’s own holding company. As the seller only works a few hours a week, this is all a valid add-back.

Computer & Internet Expenses: Here we saw a single expense of $5,500, which turned out to be the owner

Meals & Entertainment: It needs to be said that the seller went to a lot of trade shows, which shows in the business’s meals and travel expenditure. But as it turned out, nearly $16k of the Meals & Entertainment expense was actually not related to trade shows, but rather the seller choosing to expense his meetings and trips with his business partners, and as the times of all trade shows are fixed, all of this is easy to separate and prove.

Continuing Education: Finally, there was a $1,997 expense in the Continuing Education row, which turned out to be the seller taking a business education class. Certainly something useful to the seller and, in the long run, the business, but not something that would be anything more than a one-off expense.

As you can probably tell, that’s quite a substantial amount of money we’re talking about. So let’s add all of that onto the P&L to have us arrive at the final SDE figure.

There you have it – a measly $28k a year business has suddenly turned into a $112k a year one. If we assumed a 3x multiple, this would be the difference of $250,000 in its valuation.

While this example is, obviously, on the extreme end of things, in my experience in brokerage, around 9 businesses out of 10 have at least one legitimate add-back. So if you’re about to list your business for sale, make sure your broker understands the concept of add-backs and SDE and helps you put together a P&L that doesn’t have you take a hit for expenses that shouldn’t be there!

Any questions or comments – let’s chat in the comments section below!