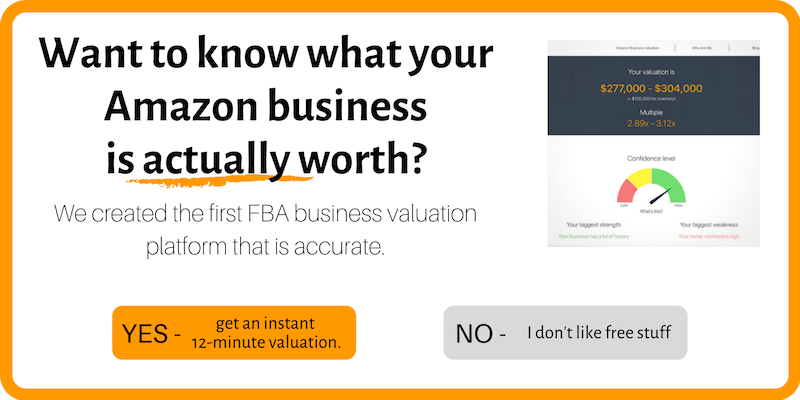

You’ve probably heard some people claim that no online platform can ever accurately value a business. Heck, I’ve said it myself (and then debunked it 2 years later).

So what’s it all about and CAN an online valuation tool really be accurate and useful?

Well, turns out it can. (but this does not mean that the vast majority of them are!)

How did we build an accurate FBA Business Valuation Tool?

Simple! (well, not really).

Check out my earlier write-up to read more about the prerequisites for what we’ve done and why I don’t consider myself a hypocrite for bashing business valuation tools, then launching one 2 years later: Does Launching a Business Valuation Tool Make Me a Hypocrite.

But in general, there are a few key ingredients that are in play here:

#1 – Amazon-Only

It’s not at all random that the Valuation Tool works with Amazon businesses only. The reason behind it is that Amazon-only businesses are inherently much simpler than online businesses in general and there are fewer moving parts. With fewer moving parts come fewer subjective metrics to take into account, reducing the need for guesswork, which is something humans are better at than computers.

#2 – Metrics

As you already know if you’ve read this blog, there are 2 pre-requisites for a successful valuation, with having the right metrics being one of them.

Our tool analyses a list of over 40 direct metrics, plus a number of indirect ones as the “basis” for each valuation. Coming up and balancing these was not a simple task and took hundreds of hours of scientific work. This goes to show how difficult it is to replicate something that a human can do in a heartbeat!

#3 – Dataset

Probably most importantly, no valuation – prepared by a human or a computer – can be accurate if the appraiser doesn’t have a sufficient and accurate list of comparables. And this is where our automated tool is actually even more accurate than some brokers and professional appraisers!

You see, myself and my team at The FBA Guys have been dealing with online business acquisitions for over 10 years and have a huge amount of data to rely on from our personal experiences alone.

To come up with the initial dataset for the Valuation Tool, we looked at over 500 past sales to build the correct “starting weights” for the metrics that we analyse. But that’s only the beginning. As the tool is used and more deals happen, the dataset will only grow, making the app more and more accurate as time goes by.

#4 – AI & Machine Learning

Lastly, we also employ Artificial Intelligence and Machine Learning to allow the app improve itself over time. This means that the valuations are not “set in stone”, but instead the app adjusts to changes in market conditions, trends and so forth.

This part of the app is constantly involving and while today, a lot of human input is needed on the back-end, this too will soon change, allowing the app to live its own life and evolve, so to speak.

And that’s all there is to it! There’s no magic. Just a lot of hard work and good source data.

What are your thoughts and comments on the accuracy of the Valuation Tool or any other similar apps you’ve come across? Let us know below.