You don’t have to be in the eCommerce game for long to hear terms like margin, gross margin and profit margin thrown around.

And for a good reason – gross margin is perhaps the most important metric of any ecommerce business. Yes – even more important than total sales. If your margin is negative, you can have billions of dollars in sales but still be losing money.

What Exactly is Gross Margin?

To avoid reinventing the wheel, let’s see what Investopedia says:

Gross margin is a company’s total sales revenue minus its cost of goods sold(COGS), divided by total sales revenue, expressed as a percentage. The gross margin represents the percent of total sales revenue that the company retains after incurring the direct costs associated with producing the goods and services it sells. The higher the percentage, the more the company retains on each dollar of sales, to service its other costs and debt obligations.

Investopedia.com

So in essence, your gross margin is the % of your sales that is yours to keep.

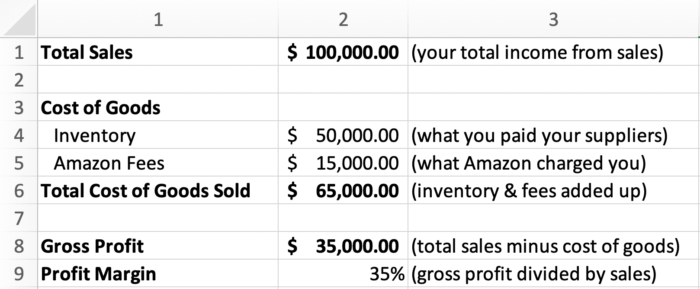

In layman terms, if you sell a widget for $100, pay your supplier $50 in cost price and Amazon $15 in selling fees then your profit is $100 – $50 – $15 = $35 and your margin is, therefore, 35%.

The actual calculation you’d need to make in the above example is 100 (total sales revenue) minus 65 (total cost of goods), divided by 100 (total sales revenue). This results in 0.35, which when expressed as a percentage, is 35%.

Easy!

But Why Is It Even Important?

In short, your profit margin is the number one metric that shows the ‘health’ and sustainability of your business.

While a business with a very slim profit margin can still be profitable, it comes with many challenges.

For starters, having a tiny gross margin means that you’re very limited in the marketing you can do, as any marketing expenses would quickly eat away all of your profit.

In addition, any price wars with competitors are likely to end up in misery as there’s only a tiny bit of room to manoeuvre with prices. And forget about holiday discounts – these just aren’t going to happen!

So as you see, while there’s no universal rule for what makes a ‘good profit margin’, she’s been lying to you all along and bigger really is better 🙂

Gross Margin vs Net Margin – What’s the Difference?

Wait, there’s more than one ?!?

If your Gross Margin shows how good your business model is then your Net Margin shows how well you run it. That’s because the net margin also takes into account your Operating Expenses.

Similarly to how it’s possible to have a billion in sales but make no money because your gross margin is negative, you can have a fantastic gross margin, but if it takes a small army to generate a few sales then the gross margin starts meaning very little as the net profit just won’t be there.

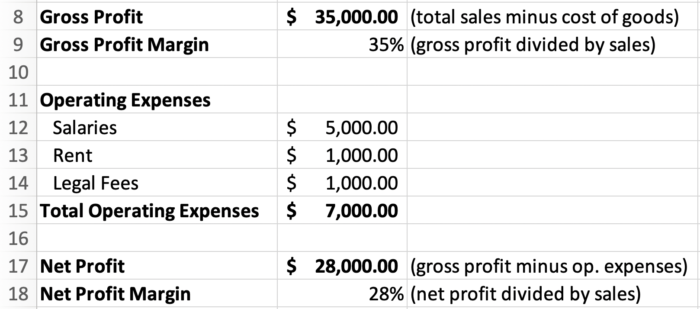

The calculation of the net margin is similar to the one we looked at above, but you’d be using your Net Profit line, not your Gross Profit line as the basis. Continuing with the same example from above, the rest of our table would look like this:

In conclusion, while these terms can be a bit difficult to grasp and intimidating to some of you starting out in the Amazon game, they’re concepts worth getting